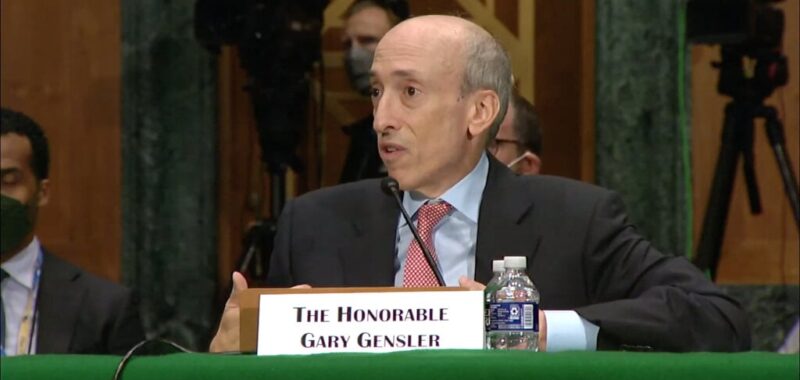

In a rare and charged appearance of all five voting members of the U.S. Security and Exchange Commision (SEC) before Congress on Tuesday, Chairman Gary Gensler batted away attack after attack on his crypto regulation record.

At one point, Gensler even denied previous knowledge of the term “Operation Choke Point 2.0,” which refers to a popular theory that there is a coordinated government effort to prevent the American crypto industry from developing and taking root.

“I’ve never heard that term,” Gensler said, smiling, in response to a pointed question from Rep. Warren Davidson (R-OH) about whether he has ever discussed Operation Choke Point 2.0 with the Chair of the Federal Reserve behind closed doors.

The nearly four-hour session before the House Financial Services Committee saw several lawmakers—mostly, but not all Republicans—condemn Gensler’s crypto policies to his face in particularly harsh terms.

“We could not have had a more historically destructive or lawless Chairman of the SEC,” Rep. Tom Emmer (R-MN), a noted crypto advocate, chided Gensler in a particularly heated exchange during which the congressman cut off the SEC Chair’s responses several times.

In perhaps the most visually remarkable element of the session, multiple SEC commissioners offered harsh critiques of Gensler’s crypto policies while sitting just feet away from him.

“We’ve taken a legally imprecise view to mask the regulatory lack of clarity,” commissioner Hester Peirce said of the SEC’s shifting stance on whether some crypto tokens constitute securities offerings in all contexts, or only in certain ones.

While Peirce, a Republican appointee to the agency, has often clashed with her Democratic chair, she has rarely had the opportunity to critique Gensler’s agenda to his face in such a public setting as a congressional hearing.

I confronted SEC Chair Gary Gensler with a deceptively simple question: Is a Yankee ticket a security?

Mr. Gensler claims that NFTs are securities. I see no legal difference between a Yankee ticket that offers access to a Yankee game and an NFT that offers access to an… pic.twitter.com/4ykD4MFV8P

— Rep. Ritchie Torres (@RepRitchie) September 24, 2024

When asked more pointedly about the SEC’s recent admission in a lawsuit that a term it has repeatedly used, “crypto asset securities,” may improperly imply that some tokens may be securities in and of themselves, Peirce conceded that the agency should have been more forthright that crypto tokens are not securities by their very nature.

“That’s something that we should have admitted long ago,” she said in response to a question from Financial Services Committee chair Rep. Patrick McHenry (R-NC).

Peirce also laid the blame for these perceived missteps squarely at Gensler’s feet. When asked what the source of the SEC’s crypto-hostile agenda was, she only gave one name.

“The agenda is the Chairman’s agenda,” Peirce said.

Edited by Andrew Hayward